Global softwood lumber markets are entering a period of significant change. After years of weak demand and high volatility, the 2025–2030 outlook points to a gradual recovery—driven by economic improvement in Europe and China, supply constraints across North America, and new trade flows emerging from tariffs and policy shifts, according to the new report Softwood Lumber – Tariffs, Turbulence, and New Trade Flows.

Slow Growth, Major Shifts

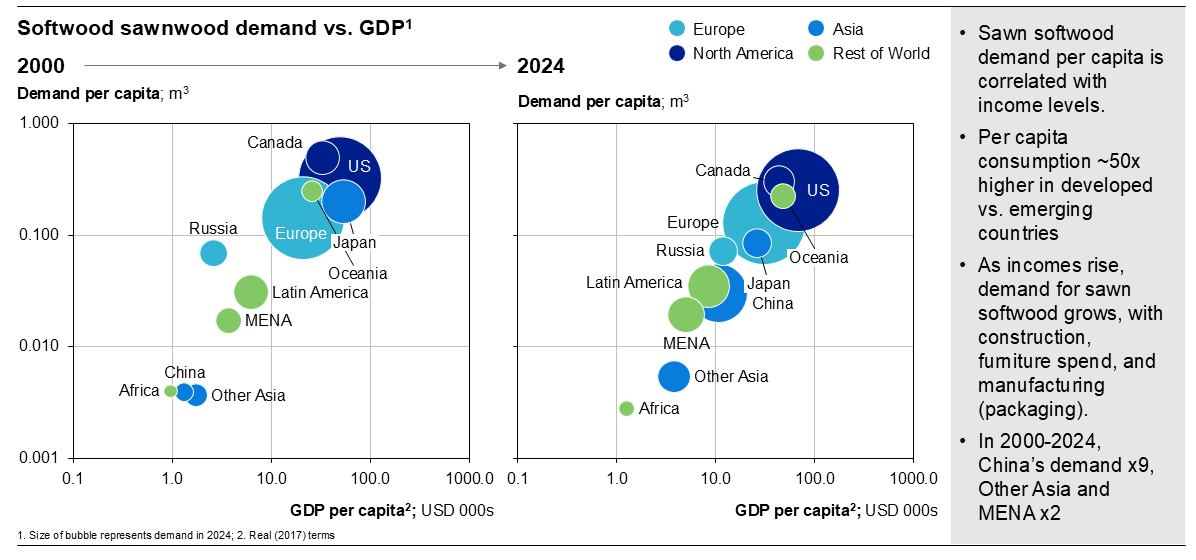

Softwood lumber remains a USD 80 billion global industry, growing only 1.8% per year in nominal terms since 2000. Beneath this modest headline, demand and trade are transforming. Consumption has shifted toward Asia, while North America and Europe remain the backbone of global supply. Construction dominates in developed markets, while furniture and packaging are key in emerging economies. Per-capita use has plateaued at 0.2–0.4 m³ in mature markets but remains below 0.1 m³ in developing regions—leaving room for growth, particularly in midincome Southeast Asia and MENA. Regional policies, tariffs, and forest resource limits will shape how demand is met, according to the report.

Figure 1: Sawnwood demand versus GDP, 2000-2024

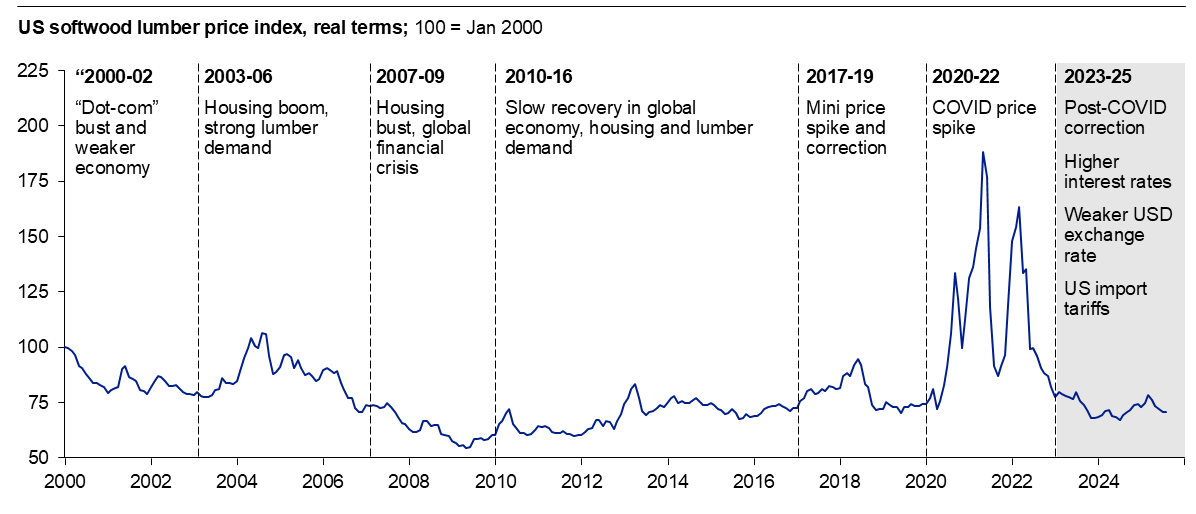

United States: Tightening Supply, Rising Prices

The United States accounts for 27% of global softwood lumber demand but only 20% of supply. After steady post-recession growth, U.S. consumption dipped in 2022 but is expected to rebound later this decade as housing starts recover. The implementation of new import tariffs in October 2025 will restrict supply and push lumber prices in the US higher. While southern mills are expanding, growth is constrained by labor shortages and log costs in other regions of the country. Based on currently announced projects, sawmill expansion in the US South appears to be slowing in 2025–27. The report notes that imports will increasingly need to come from Europe towards the end of the five-year period.

Figure 2: Softwood lumber prices, United States

Canada and Europe: Adjusting to Constraints

Canada’s lumber sector faces a structural downturn. Higher U.S. duties (from 14% to 45% for most producers) and limited log supply in British Columbia will accelerate mill closures and investment shifts toward the U.S. South. Efforts to diversify exports to Asia and Europe are slow and costly due to distance and differing standards. According to the new report, Canada’s overall production will likely contract further. As BC sawmills become less competitive in the US market, there are opportunities to expand domestic sales and to expand production of valueadded products through recent government incentives. Europe, which accounts for one-third of global supply, is poised for modest growth as construction confidence improves. But production in Northern and Central Europe is near its sustainable ceiling, and beetle-related harvests in Central Europe are declining. Expansion will depend on Eastern Europe and the Baltics.

China and Beyond: A Gradual Rebound

China’s lumber demand, down 34% since 2017, is expected to recover modestly after 2027 as the property market stabilizes. Russia will remain its dominant supplier, with marginal increases from Canada. Demand in MENA and mid-income Asia (e.g., Vietnam, India) will also grow, though limited by local forest resources, they will predominantly rely on imports.

A Fragmented Global Market

Overall, global lumber demand is projected to grow 1.2% annually from 2024 to 2030, reaching 335 million m³. Seventy percent of this increase will come from the U.S., Europe, and China. Meeting that demand will require roughly 22 million m³ of new supply—mostly from the U.S. South, Eastern Europe, and Russia’s Far East. According to the report, the decade ahead will be defined not by strong growth but by redistribution—as tariffs, trade barriers, and forest policy reshape traditional supply chains. The winners will be those who adapt fastest to this new geography of wood.

For more information:

- Glen O’Kelly, O’Kelly Acumen – glen.okelly@okelly.se

- Håkan Ekström, Global Wood Trends – hakan@globalwoodtrends.com

The full report is available for order at: https://www.okelly.se/shop/lumber2025